Cfd trading meaning

Leverage allows you to decrease the size of your deposit and use your capital more effectively. Leverage trading involves using the cash in your brokerage account as a deposit, known as margin, so that you only put up a percentage of the cost of buying a position Versus Trade. When trading with leverage, potential profits or losses will be calculated according to the full size of your position, not just the margin.

Contracts for difference can be used to trade many assets and securities, including exchange-traded funds (ETFs). Traders will also use these products to speculate on the price moves in commodity futures contracts such as those for crude oil and corn. Futures contracts are standardized agreements or contracts with obligations to buy or sell a particular asset at a preset price with a future expiration date.

Going short involves selling a CFD with the expectation that the price of the underlying asset will fall. Traders profit from the price difference between the entry point and the exit point when they close the position. If the market moves in the expected direction (downward in this case), the trader makes a profit. Going short allows traders to profit from declining markets, and it’s a way to capitalize on assets they believe will lose value.

Few or no fees are charged for trading a CFD. Brokers make money from the trader paying the spread. The trader pays the ask price when buying and takes the bid price when selling or shorting. The brokers take a piece or spread on each bid and ask price that they quote.

Cfd trading platform

CFD platform selection: Traders at IG can place CFD trades on its web platform and its award-winning mobile trading app (IG took home honors for the #1 Mobile App in the ForexBrokers.com 2025 Annual Awards). Also available is IG’s L2 Dealer direct market access (DMA) platform; L2 Dealer provides both Level 1 and Level 2 pricing, with the latter offering a more in-depth view of the market by granting access to the exchange order book. Traders at IG also gain access to its ProRealTime charting package, a trading platform that includes charting software allowing users to trade directly from charts.

On the contrary, the platform also offers CFD markets on stocks, indices, cryptocurrencies, bonds, interest rates, commodities, indices, and more. Once again, these markets not only cover major exchanges – but the emerging economies too. In terms of supported platforms, IG offers its own native web trading facility that can be accessed online or via the mobile app.

I think CFDs provide an interesting alternative to stock trading for international traders. CFD traders never own the underlying asset, which allows better access and lower fees in short selling hard-to-borrow U.S. stocks. There can be tax advantages – although you should consult a tax professional to determine your responsibility.

In 2025, I ranked Interactive Brokers in first place for our Range of Investments category due to the sheer number of available markets and global exchanges. It should come as no surprise that Interactive Brokers is also a great choice for CFD trading, even if its range of CFDs is not as extensive as IG or Saxo. Interactive Brokers covers the most popular CFD markets and caters equally well to beginner and advanced traders, thanks to its variety of platforms, ranging from basic to highly advanced.

Extensive selection of CFDs: Saxo offers one of the largest selection of CFDs of the 60+ forex brokers I review. A true multi-asset broker, Saxo also offers underlying shares, exchange-traded turbos, futures, options, ETFs, mutual funds, bonds, and over the counter (OTC) forex and options trading. Many of these asset classes can be traded as CFDs at Saxo, across global markets and with competitive trading conditions.

Trading cfd

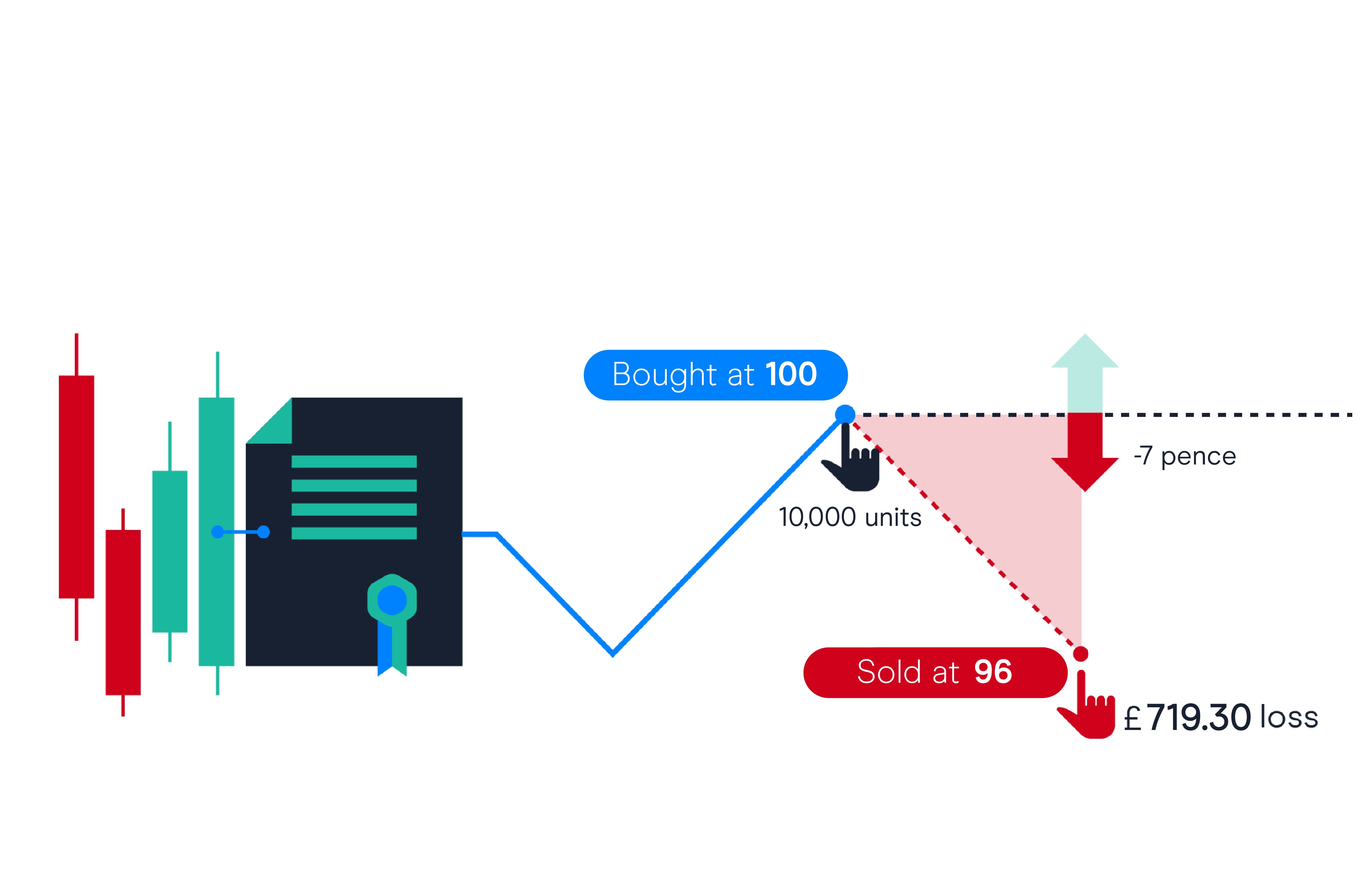

CFD trading, or Contract for Difference trading, is a financial arrangement where you don’t actually buy or sell the underlying asset (like stocks, commodities, or currencies), but instead, you enter into a contract with a broker to speculate on its price movements. The name “Contract for Difference” comes from the agreement to exchange the difference in the asset’s value between the opening and closing of the contract.

Traditional investing usually involves following a simple strategy: “buy low, sell high.” CFD trading follows that same pattern, but investors can also use an alternative method to try and profit from market moves: “sell high, buy low.”

Going short involves selling a CFD with the expectation that the price of the underlying asset will fall. Traders profit from the price difference between the entry point and the exit point when they close the position. If the market moves in the expected direction (downward in this case), the trader makes a profit. Going short allows traders to profit from declining markets, and it’s a way to capitalize on assets they believe will lose value.

Contract for Difference (CFD) trading is a financial derivative that allows traders to speculate on the price movements of various financial instruments without actually owning the underlying assets. CFDs are popular in financial markets, including stocks, indices, commodities, currencies, and cryptocurrencies. This article will help you understand CFD trading better.

CFD trading, or Contract for Difference trading, is a financial arrangement where you don’t actually buy or sell the underlying asset (like stocks, commodities, or currencies), but instead, you enter into a contract with a broker to speculate on its price movements. The name “Contract for Difference” comes from the agreement to exchange the difference in the asset’s value between the opening and closing of the contract.

Traditional investing usually involves following a simple strategy: “buy low, sell high.” CFD trading follows that same pattern, but investors can also use an alternative method to try and profit from market moves: “sell high, buy low.”

Cfd trading meaning

Understanding this is quite simple: If you believe the price will go up, you want to be the buyer. If you buy a stock for $200, and it increases in price to $250, you can sell it back and make $50 in profit.

When you open a CFD trade with a broker, you deposit the margin while the broker provides the rest of the notional value of the position. While leverage gives you greater exposure to financial markets, it also increases your risk as your profit or loss is based on the full notional value of your position.

This means you could use some of your remaining capital to place a similar size trade in an asset like UK Government Bonds. (Many traders see bonds as a ‘safe haven’ asset, which means they will often rise in value as stocks fall in price.)

Commodity CFDs allow traders to speculate on the price movements of commodities such as gold, oil, and wheat. Commodity CFDs offer traders exposure to the commodity markets, without having to physically own the underlying asset. Commodity CFDs can be traded with leverage, allowing traders to amplify their potential profits.

Cryptocurrency CFDs allow traders to speculate on the price movements of cryptocurrencies such as Bitcoin, Ethereum, and Litecoin. Cryptocurrency CFDs offer traders the ability to trade the volatile crypto markets with leverage, without having to own the underlying asset.

Leave a Reply